Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Unlocking the Future of Finance: Novel Methods in Computational Finance Mathematics in Industry 25

Gone are the days when finance was solely managed by human intuition and experience. In today's fast-paced world, the financial industry heavily relies on the power of computational mathematics to make accurate predictions and drive decision-making. The ongoing advancements in this field continue to revolutionize the way financial institutions operate and pave the way for a future built on data-driven strategies.

The Intersection of Mathematics and Finance

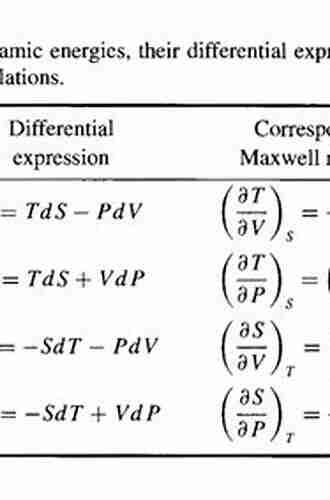

Computational finance mathematics involves the application of mathematical algorithms and computer-based models to understand and solve complex financial problems. It enables financial analysts, traders, and risk managers to efficiently assess market trends, optimize investment strategies, and manage uncertainties. With the abundance of data available in the digital age, scaling up mathematical models to handle large datasets is becoming increasingly crucial.

Numerous mathematical methods have been developed over the years to tackle specific financial challenges. From the widely known Black-Scholes model to the more recent machine learning algorithms, these tools have shaped the financial landscape and enhanced our ability to manage risks and capitalize on opportunities.

5 out of 5

| Language | : | English |

| File size | : | 23248 KB |

| X-Ray for textbooks | : | Enabled |

| Print length | : | 624 pages |

| Screen Reader | : | Supported |

Industry 25: Pushing Boundaries in Computational Finance

The Mathematics in Industry Study Group (MISG) is a collaborative annual workshop that brings together mathematicians and industry professionals to address real-world problems faced by companies. In its 25th iteration, the MISG focuses on novel methods in computational finance, paving the way for groundbreaking developments in the field.

One of the key areas of focus in Industry 25 is the use of artificial intelligence (AI) and machine learning (ML) techniques in finance. These methods leverage large datasets and powerful computing capabilities to uncover patterns and predict future market behavior with higher accuracy. The applications of AI and ML in finance range from algorithmic trading and risk management to fraud detection and loan underwriting.

The development of robust mathematical models that integrate AI techniques is reshaping how financial institutions analyze and manage risks. These models can process vast amounts of financial data in real-time, enabling timely decision-making based on accurate predictions. As a result, financial institutions can optimize their operations, reduce costs, and gain a competitive edge in the market.

The Promise of Quantum Computing in Finance

While AI and ML techniques are revolutionizing finance, the emergence of quantum computing introduces a new dimension of possibilities. Quantum computers have the potential to perform complex calculations at an exponentially faster rate compared to classical computers, unlocking new opportunities for solving intricate financial problems.

Quantum finance leverages the principles of quantum mechanics to design algorithms that can efficiently analyze vast financial data sets. This approach can have a profound impact on various financial domains, such as portfolio optimization, option pricing, and risk management. Furthermore, quantum cryptography can drastically enhance the security of financial transactions, protecting sensitive information from potential cyber threats.

The Challenges Ahead

While novel methods in computational finance bring immense potential, there are several challenges that need to be addressed. One of the significant concerns is the ethical implications of relying heavily on algorithms and machine-driven decision-making. It is crucial to ensure transparency and accountability in these systems to avoid biases and maintain fairness.

Additionally, the rapid developments in computational finance require experts who possess a deep understanding of both mathematics and finance. The educational curriculum needs to adapt to equip aspiring professionals with the necessary skills and knowledge to excel in this evolving field.

The Future of Finance

As computational finance continues to push boundaries, we can anticipate a future where machine learning algorithms and quantum computers play a pivotal role in financial decision-making. These novel methods will enhance efficiency, accuracy, and profitability across various financial sectors.

The interdisciplinary nature of computational finance allows collaboration between mathematicians, computer scientists, and financial experts, fostering innovation and driving new discoveries. With constantly evolving technologies and mathematical advancements, the finance industry will remain at the forefront of innovation, embracing new horizons and unlocking the full potential of computational finance.

Achieving Financial Transformation

, the novel methods in computational finance showcased in Industry 25 bring about a transformative impact on the financial industry. With the integration of AI, ML, and quantum computing, financial institutions can harness the power of data-driven decision-making like never before.

However, it is vital to address the challenges that arise with this advancement and ensure ethical and responsible use of these technologies. Ultimately, the future of finance lies in the hands of those who navigate the intersection of mathematics and industry, harnessing the potential of computational finance to shape a new era of financial success.

5 out of 5

| Language | : | English |

| File size | : | 23248 KB |

| X-Ray for textbooks | : | Enabled |

| Print length | : | 624 pages |

| Screen Reader | : | Supported |

This book discusses the state-of-the-art and open problems in computational finance. It presents a collection of research outcomes and reviews of the work from the STRIKE project, an FP7 Marie Curie Initial Training Network (ITN) project in which academic partners trained early-stage researchers in close cooperation with a broader range of associated partners, including from the private sector.

The aim of the project was to arrive at a deeper understanding of complex (mostly nonlinear) financial models and to develop effective and robust numerical schemes for solving linear and nonlinear problems arising from the mathematical theory of pricing financial derivatives and related financial products. This was accomplished by means of financial modelling, mathematical analysis and numerical simulations, optimal control techniques and validation of models.

In recent years the computational complexity of mathematical models employed in financial mathematics has witnessed tremendous growth. Advanced numerical techniques are now essential to the majority of present-day applications in the financial industry.

Special attention is devoted to a uniform methodology for both testing the latest achievements and simultaneously educating young PhD students. Most of the mathematical codes are linked into a novel computational finance toolbox, which is provided in MATLAB and PYTHON with an open access license. The book offers a valuable guide for researchers in computational finance and related areas, e.g. energy markets, with an interest in industrial mathematics.

Allen Ginsberg

Allen GinsbergKathy Santo Dog Sense Kathy Santo - Unlocking the secrets...

Are you a dog lover who...

Raymond Parker

Raymond Parker10 Presidents Who Were Killed In Office - Shocking Truth...

Throughout history, the role of a president...

Isaac Asimov

Isaac AsimovUnveiling a World of Magic: Beautifully Illustrated...

Bedtime stories have always held a...

James Joyce

James JoyceThe Blind Parables: An Anthology Of Poems

For centuries, poetry has...

Clay Powell

Clay PowellRival Conceptions Of Freedom In Modern Iran

The Struggle for Freedom in...

Cristian Cox

Cristian CoxAdvances In Their Chemistry And Biological Aspects

In recent years,...

Dominic Simmons

Dominic SimmonsGetting Into Mini Reefs For The Marine Aquarium

Are you interested in enhancing the...

Vincent Mitchell

Vincent MitchellExploring the Intriguing Connection Between History,...

When one thinks of Chinese martial...

Christian Barnes

Christian BarnesMighty Meg And The Accidental Nemesis: Unleashing the...

In the world of superheroes, there are many...

Kirk Hayes

Kirk HayesA Journey through the World of Nhb Drama Classics: Full...

Welcome to a fascinating exploration of Nhb...

Gerald Bell

Gerald BellWeed Cross Stitch Pattern Rachel Worth - The Perfect...

Are you a stoner who loves a little...

Ernesto Sabato

Ernesto SabatoDiscover the Breathtaking Beauty of the South West Coast...

Are you ready for an...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Stanley BellDiscover the Easiest Way to Define and Train Neural Network Models with Just...

Stanley BellDiscover the Easiest Way to Define and Train Neural Network Models with Just...

Jared PowellGrown Alone Dating With Purpose In Mind - Unlocking a Fulfilling Relationship

Jared PowellGrown Alone Dating With Purpose In Mind - Unlocking a Fulfilling Relationship

Alexandre DumasUnveiling the Mysteries: The Fascinating Journey of Chemistry from Alchemy to...

Alexandre DumasUnveiling the Mysteries: The Fascinating Journey of Chemistry from Alchemy to... Colin RichardsonFollow ·16.4k

Colin RichardsonFollow ·16.4k Connor MitchellFollow ·10.2k

Connor MitchellFollow ·10.2k Brody PowellFollow ·17.5k

Brody PowellFollow ·17.5k Guillermo BlairFollow ·10k

Guillermo BlairFollow ·10k Theo CoxFollow ·14.5k

Theo CoxFollow ·14.5k Kenzaburō ŌeFollow ·7.2k

Kenzaburō ŌeFollow ·7.2k Brennan BlairFollow ·11.8k

Brennan BlairFollow ·11.8k Beau CarterFollow ·12.3k

Beau CarterFollow ·12.3k