Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

How Venture Capital Is Broken And Needs 21st Century Tech To Fix It

Venture capital has long been regarded as the fuel that drives innovation and growth in the business world. It has enabled countless startups to transform their ideas into successful companies, generating new jobs, opportunities, and advancements in various industries. However, the traditional venture capital model is now showing signs of strain, struggling to keep up with the fast-paced, tech-driven world we live in.

The Broken Venture Capital System

The current venture capital system is plagued with inherent flaws that hinder its ability to adapt and fully leverage the opportunities of the 21st century. One of the most significant issues is the lack of transparency. Entrepreneurs often find it challenging to connect with the right investors, as the vetting process can be convoluted and subjective. Simultaneously, investors face difficulties in identifying promising startups, resulting in missed opportunities.

Another problem lies in the centralized nature of the current model. Traditional venture capital firms tend to be concentrated in specific geographic regions, leaving entrepreneurs from less well-represented areas struggling to secure funding. Moreover, the process of securing funding is time-consuming, involving numerous face-to-face meetings and negotiations, which can significantly impede progress and hinder innovation.

4.7 out of 5

| Language | : | English |

| File size | : | 2626 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 91 pages |

| Lending | : | Enabled |

| Paperback | : | 312 pages |

| Item Weight | : | 15 ounces |

| Dimensions | : | 6 x 0.71 x 9 inches |

The Need for 21st Century Technology

To address the shortcomings of the current venture capital system, we need to embrace 21st-century technology that can disrupt and revolutionize the industry. One such technology with great potential is blockchain. By utilizing decentralized ledgers, blockchain can enhance transparency, reliability, and security throughout the venture capital process.

With blockchain, entrepreneurs can showcase their projects in a decentralized platform accessible to a global network of investors. This eliminates geographical limitations and facilitates the discovery of promising startups that may otherwise go unnoticed. Additionally, blockchain's transparent nature ensures that the vetting process is fair and unbiased, providing equal opportunities to all participants.

Smart contracts, powered by blockchain, can further streamline the funding process. These self-executing contracts automatically enforce the terms and conditions predetermined by both the entrepreneurs and investors. By removing intermediaries and reducing administrative burdens, smart contracts expedite and simplify the fundraising process, enabling startups to focus on what truly matters – innovation.

The Rise of Crowdfunding and Equity Crowdfunding

Alongside blockchain, crowdfunding and equity crowdfunding have already demonstrated their potential as viable alternatives to traditional venture capital. Crowdfunding allows entrepreneurs to raise funds from a large pool of individual investors, bypassing the traditional venture capital intermediaries. The success stories of platforms like Kickstarter and Indiegogo illustrate the crowd's willingness to support innovative ideas.

Equity crowdfunding takes this concept further by enabling individuals to invest in startups in exchange for equity shares. This democratizes venture capital, making it accessible to a wider range of potential investors from diverse backgrounds. Startups benefit from increased exposure and the ability to tap into passionate communities aligned with their vision and goals.

The Promise of Artificial Intelligence

Another 21st-century technology that can significantly impact the venture capital landscape is artificial intelligence (AI). AI-powered algorithms can analyze vast amounts of data, predict market trends, and identify potential investment opportunities with unprecedented accuracy and speed. This efficiency eliminates much of the guesswork involved in traditional investment decisions.

By leveraging machine learning algorithms, venture capitalists can enhance their ability to identify promising startups, assess market potential, and make informed investment decisions. AI can also assist in portfolio management by monitoring and analyzing the performance of invested companies in real-time, providing valuable insights and early warnings.

Venture capital is an integral part of the entrepreneurial ecosystem, but its traditional model is showing signs of strain. To overcome the limitations of the current system, it is crucial to embrace 21st-century technologies like blockchain, crowdfunding, equity crowdfunding, and artificial intelligence. These technologies have the potential to reshape and fix the broken venture capital industry, empowering entrepreneurs, decentralizing access to funding, and fueling innovation on a global scale.

The time is ripe for a new era of venture capital – one that leverages the advancements of the 21st century to foster a more transparent, inclusive, and efficient ecosystem. By embracing new technologies, we can ensure that opportunities are not limited by geography, biases, or outdated processes, allowing innovation to thrive in a truly global and interconnected world.

4.7 out of 5

| Language | : | English |

| File size | : | 2626 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 91 pages |

| Lending | : | Enabled |

| Paperback | : | 312 pages |

| Item Weight | : | 15 ounces |

| Dimensions | : | 6 x 0.71 x 9 inches |

Venture Capital (VC) and angel investors are the lifeblood of startups and really Silicon Valley and it is broken along with the Silicon Valley Model. It is more understandable why angel investors and other qualified investors do not use more sophisticated high tech solutions to improve their investments, but VCs have no excuses. VCs do not use the technology they fund to improve their dreadful investment record or better the startup industry. However, technology can significantly improve their success rate and this eBook offers a solution to alleviate and improve the illness that the venture capital and startup industry has and points to ways that the Silicon Valley Method, which worked so well in the beginning, can also be improved.

If venture capital was a surgeon they would kill 75% of their patients and would soon land in jail. Yet for decades VCs have accepted dreadful success rates while maintaining Dark Age business practices which ignore the rich resources that many tech companies they fund can bring them to improve their success rate.

Why improve VC when things seem to be going well? Right now as Elon Musk has said “Being an entrepreneur is like eating glass and staring into the abyss of death…” and this pain is not necessary as rites of passages have been outlawed for hundreds of years for the rest of us, yet pain remains part of the startup industry. This does not need to happen as there are better more humane ways of weeding out the bad ideas and poor entrepreneurs using high tech. Also venture capital has a social responsibility to help improve the future for society, their investors, entrepreneurs, and startups by vastly reducing bad investments and investing in more startups. It is a win all the way around! Technology can help do this and make the process less painful and fairer! This book illustrates many problems and offers one such solution!

Allen Ginsberg

Allen GinsbergKathy Santo Dog Sense Kathy Santo - Unlocking the secrets...

Are you a dog lover who...

Raymond Parker

Raymond Parker10 Presidents Who Were Killed In Office - Shocking Truth...

Throughout history, the role of a president...

Isaac Asimov

Isaac AsimovUnveiling a World of Magic: Beautifully Illustrated...

Bedtime stories have always held a...

James Joyce

James JoyceThe Blind Parables: An Anthology Of Poems

For centuries, poetry has...

Clay Powell

Clay PowellRival Conceptions Of Freedom In Modern Iran

The Struggle for Freedom in...

Cristian Cox

Cristian CoxAdvances In Their Chemistry And Biological Aspects

In recent years,...

Dominic Simmons

Dominic SimmonsGetting Into Mini Reefs For The Marine Aquarium

Are you interested in enhancing the...

Vincent Mitchell

Vincent MitchellExploring the Intriguing Connection Between History,...

When one thinks of Chinese martial...

Christian Barnes

Christian BarnesMighty Meg And The Accidental Nemesis: Unleashing the...

In the world of superheroes, there are many...

Kirk Hayes

Kirk HayesA Journey through the World of Nhb Drama Classics: Full...

Welcome to a fascinating exploration of Nhb...

Gerald Bell

Gerald BellWeed Cross Stitch Pattern Rachel Worth - The Perfect...

Are you a stoner who loves a little...

Ernesto Sabato

Ernesto SabatoDiscover the Breathtaking Beauty of the South West Coast...

Are you ready for an...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Cody RussellThe Fundamental Nature And Structure Of Space Time - Lecture Notes In Physics...

Cody RussellThe Fundamental Nature And Structure Of Space Time - Lecture Notes In Physics...

George MartinUnveiling the Masterpieces of Drawn Chris Ledbetter: An Artist Who Brings...

George MartinUnveiling the Masterpieces of Drawn Chris Ledbetter: An Artist Who Brings...

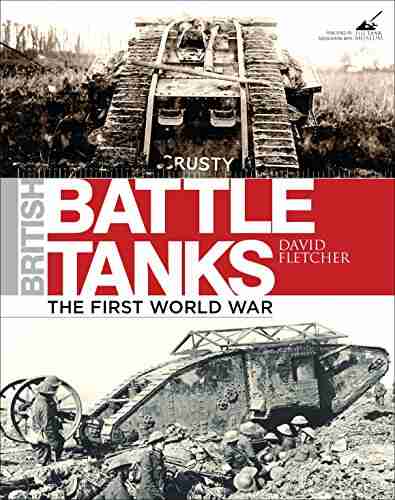

Dennis HayesThe Invincible Iron Giants: A Journey Through British Battle Tanks in World...

Dennis HayesThe Invincible Iron Giants: A Journey Through British Battle Tanks in World... Zachary CoxFollow ·10.5k

Zachary CoxFollow ·10.5k Eddie BellFollow ·16.8k

Eddie BellFollow ·16.8k Neil ParkerFollow ·16.1k

Neil ParkerFollow ·16.1k Yasushi InoueFollow ·11.6k

Yasushi InoueFollow ·11.6k Marcel ProustFollow ·19.2k

Marcel ProustFollow ·19.2k Dylan HayesFollow ·9.6k

Dylan HayesFollow ·9.6k Dawson ReedFollow ·4.1k

Dawson ReedFollow ·4.1k Cameron ReedFollow ·14.7k

Cameron ReedFollow ·14.7k