Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

The Zen Of Steve Jobs Raising Venture Capital Vol.

Steve Jobs, the co-founder of Apple Inc., was not only a technological genius but also a master at raising venture capital for his projects. His ability to secure funding and convince venture capitalists to invest in his ideas was legendary. In this article, we will explore the Zen-like qualities that Jobs displayed during his fundraising endeavors and how they can be applied by modern entrepreneurs.

1. Connecting with the Vision

One of the key aspects of Jobs' success in raising venture capital was his ability to deeply connect with his vision. He had a clear understanding of his goals and was able to convey his ideas with passion and conviction. Entrepreneurs today can learn from this approach by diving deep into their own vision and becoming truly immersed in it. When you are able to communicate your vision with utmost clarity and passion, venture capitalists are more likely to get onboard.

2. Creating a Compelling Narrative

Jobs had a unique talent for storytelling. He had the ability to captivate audiences with his narratives, making them believe in his dreams. When raising venture capital, it is important to create a compelling narrative around your project. This involves clearly articulating the problem you are solving, presenting your solution, and highlighting the potential market size. By creating a story that intrigues and excites venture capitalists, you stand a better chance of securing funding.

4.7 out of 5

| Language | : | English |

| File size | : | 923 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 98 pages |

| Lending | : | Enabled |

3. Mastering the Art of Persuasion

Jobs was a master persuader. He knew how to convince venture capitalists that his ideas were worth investing in. He had a deep understanding of his audience, their needs, and their preferences. Modern entrepreneurs can benefit from this by researching and understanding their potential investors. By tailoring your pitch to address their concerns and aligning your project with their investment criteria, you increase the likelihood of securing their support.

4. Embracing Failure as a Learning Experience

Despite his immense success, Jobs experienced multiple failures throughout his career. However, instead of being deterred by them, he used them as learning experiences. Jobs understood that failure is a natural part of the journey towards success. When presenting your project to venture capitalists, it is important to acknowledge potential risks and demonstrate how you have learned from past failures to mitigate them. This shows resilience and a growth mindset, greatly enhancing your credibility.

5. Cultivating Relationships

Jobs was known for his ability to cultivate long-term relationships with venture capitalists. He understood the value of building trust and maintaining open lines of communication. As an entrepreneur seeking venture capital, it is essential to invest time and effort in building relationships with potential investors. Attend networking events, industry conferences, and connect with them on professional platforms. This not only increases your chances of securing funding but also helps you form valuable mentorships.

6. Presenting a Strong Team

Jobs recognized the importance of presenting a strong team when raising venture capital. He surrounded himself with talented individuals who shared his vision and could contribute to the success of the project. When seeking funding, it is crucial to highlight the expertise and capabilities of your team. Venture capitalists want to invest in teams that have the right skills and experience to execute the proposed project effectively. By showcasing a well-rounded and capable team, you significantly increase your chances of receiving funding.

Steve Jobs' Zen-like approach to raising venture capital revolutionized the tech industry and inspired countless entrepreneurs. By connecting with your vision, creating a compelling narrative, mastering persuasion techniques, embracing failure as a learning experience, cultivating relationships, and presenting a strong team, you can adopt Jobs' principles to enhance your own fundraising efforts. Remember, raising venture capital requires a combination of passion, resilience, and strategic thinking. Apply these principles with dedication, and you may find yourself following in the footsteps of the legendary Steve Jobs.

4.7 out of 5

| Language | : | English |

| File size | : | 923 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 98 pages |

| Lending | : | Enabled |

Publisher Comments

Entrepreneurs can build a raging bonfire with the stacks of books and articles explaining the process of raising venture capital; but if you are looking for a comprehensive tactical approach built on a single philosophy that is proven to work, you must read The Zen of Steve Jobs & Raising Venture Capital.

Who knew VCs are people too? Most entrepreneurs think of them as calculating investors ready to steal their companies. Not so according to Michael Sage. He reveals a simple philosophy that makes the approach to raising venture capital much easier to understand.

What’s so compelling about this guide is that Sage uses his considerable experience both as an entrepreneur and a VC in what is arguably the first attempt we could find to provide a unifying philosophy to such a nuanced and arduous process. Throughout three volumes Michael Sage lays out in meticulous detail the critical knowledge and tactics required to successfully raise venture capital unified around one simple idea, raising venture capital is about the pursuit of a crucial relationship. Sage explains how to achieve it in every step of the process.

As an entrepreneur-venture capital Jekyll and Hyde he manages to walk on both sides of the line empathizing with the plight of the entrepreneur while tapping his vast knowledge as a VC. The Guide takes you through a logical journey for pursuing venture capital while injecting how-to tips and insights through the use of innovative sections called VC Thoughts. This is where Sage puts on his VC hat and delivers very direct advice in a somewhat blunt “this is how it is” style.

If that wasn’t enough, Mr. Sage further proceeds to tie-in the inspiring words of Steve Jobs. He effectively uses the Zen of Jobs to draw an intriguing parallel to emphasize the importance of relationship-building in the pursuit of venture capital.

There is no doubt upon reading The Zen of Steve Jobs & Raising Venture Capital you will be convinced by the words of Michael Sage, “If you learn what I know you will not struggle and hate the process of raising venture capital.”

CTC Publishing-Entrepreneur Series, New York, New York

The Zen of Steve Jobs & Raising Venture Capital delivers both the experienced wisdom of a successful Venture Capitalist and Entrepreneur and the spirit of Steve Jobs in his own words; an easy-to-follow practical 3-Volume success guide including winning tactics for attracting VCs, winning pitch documents, winning meeting tactics, winning valuation tactics, and winning negotiation tactics. Inspired by the intense relationship Steve Jobs forged with his customer, Mike Sage explains the critical mind-set and the knowledge required to make raising venture capital more manageable with a clear strategy.

Get inside a VCs head; over sixty "VC Thoughts" sectioned-off to highlight critical tips and instructions based on how VCs think in every step. Bonuses in each volume include: easy-to reference VC screening checklist, winning pitch document template, and sample term sheet.

Table of Contents

1: P.D.A. - Principles for Success

2: The Game Plan: A Winning Financing Strategy

3: Why do you want Venture Capital?

4: Overview: The Venture Capital Process

5: How Does a VC Analyze Your Business?

6: How Does a VC Assess You?

7: Strategy for Attracting VCs

8: Winning Pitch Documents

Appendix A - Pitch Doc Templates

**Bonus Vol. II: Chapter 10 - Screening & Initial Contact (Intro)

Allen Ginsberg

Allen GinsbergKathy Santo Dog Sense Kathy Santo - Unlocking the secrets...

Are you a dog lover who...

Raymond Parker

Raymond Parker10 Presidents Who Were Killed In Office - Shocking Truth...

Throughout history, the role of a president...

Isaac Asimov

Isaac AsimovUnveiling a World of Magic: Beautifully Illustrated...

Bedtime stories have always held a...

James Joyce

James JoyceThe Blind Parables: An Anthology Of Poems

For centuries, poetry has...

Clay Powell

Clay PowellRival Conceptions Of Freedom In Modern Iran

The Struggle for Freedom in...

Cristian Cox

Cristian CoxAdvances In Their Chemistry And Biological Aspects

In recent years,...

Dominic Simmons

Dominic SimmonsGetting Into Mini Reefs For The Marine Aquarium

Are you interested in enhancing the...

Vincent Mitchell

Vincent MitchellExploring the Intriguing Connection Between History,...

When one thinks of Chinese martial...

Christian Barnes

Christian BarnesMighty Meg And The Accidental Nemesis: Unleashing the...

In the world of superheroes, there are many...

Kirk Hayes

Kirk HayesA Journey through the World of Nhb Drama Classics: Full...

Welcome to a fascinating exploration of Nhb...

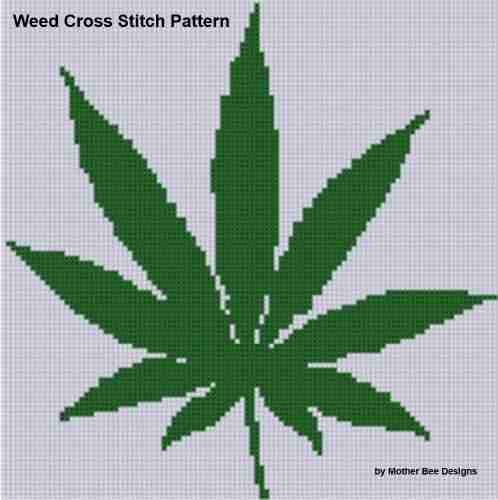

Gerald Bell

Gerald BellWeed Cross Stitch Pattern Rachel Worth - The Perfect...

Are you a stoner who loves a little...

Ernesto Sabato

Ernesto SabatoDiscover the Breathtaking Beauty of the South West Coast...

Are you ready for an...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Marcel ProustThe Astonishing and Gripping Adventure of The Courageous Bride Racing Against...

Marcel ProustThe Astonishing and Gripping Adventure of The Courageous Bride Racing Against...

Douglas Powell10 Foolproof Tips on How to Become a People Magnet - Unleash Your Charisma...

Douglas Powell10 Foolproof Tips on How to Become a People Magnet - Unleash Your Charisma...

Elliott CarterUnlocking the Secrets: Powerful Tools for the Characterization of Polymers,...

Elliott CarterUnlocking the Secrets: Powerful Tools for the Characterization of Polymers,... Quincy WardFollow ·2.6k

Quincy WardFollow ·2.6k Isaiah PowellFollow ·11.3k

Isaiah PowellFollow ·11.3k Tyrone PowellFollow ·3.8k

Tyrone PowellFollow ·3.8k Stephen FosterFollow ·5.2k

Stephen FosterFollow ·5.2k Branden SimmonsFollow ·19.1k

Branden SimmonsFollow ·19.1k Bryan GrayFollow ·5k

Bryan GrayFollow ·5k Truman CapoteFollow ·9.1k

Truman CapoteFollow ·9.1k Griffin MitchellFollow ·2.3k

Griffin MitchellFollow ·2.3k