Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Uncovering the Profound Impacts of the Covid-19 Crisis on Private Equity Funds in Emerging Markets

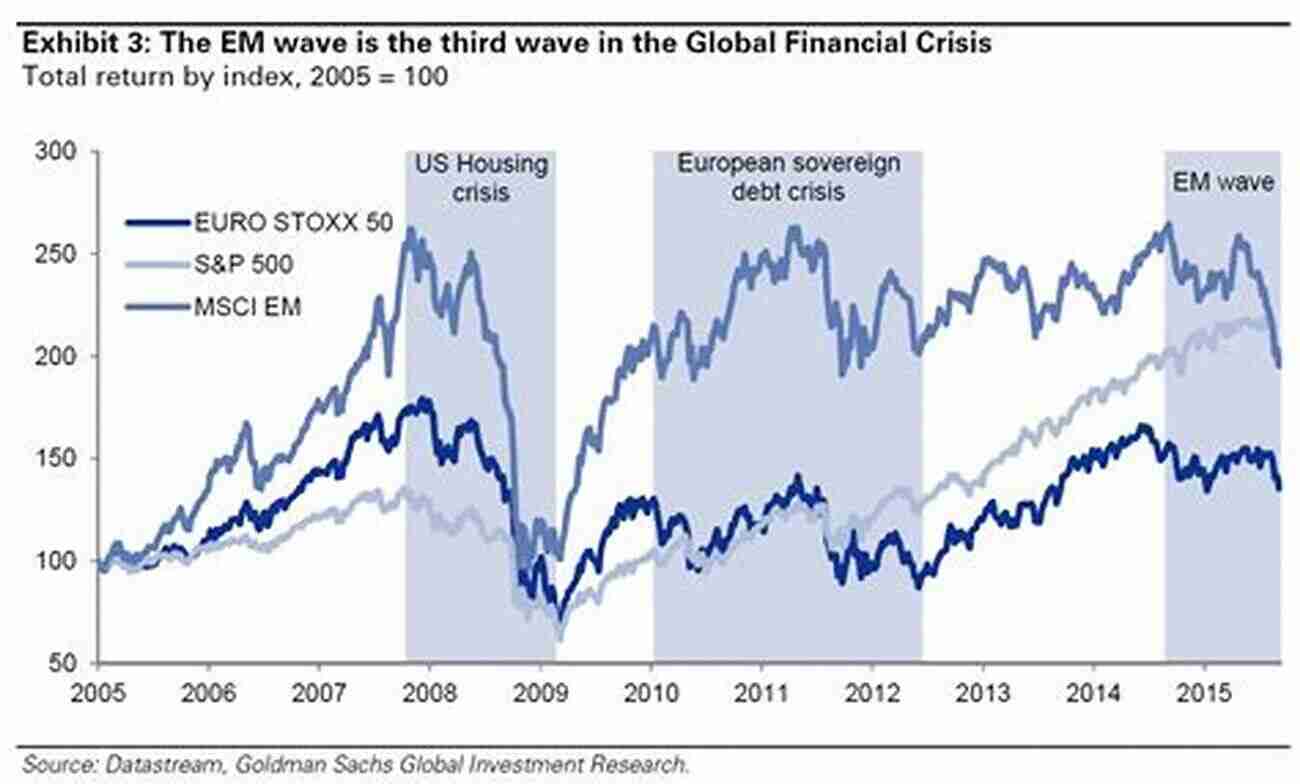

With the outbreak of the Covid-19 pandemic, the private equity landscape in emerging markets has been subjected to unparalleled challenges. The far-reaching impacts of this global crisis have shaken economies and disrupted traditional investment models. In this article, we delve deep into the ripple effects of the Covid-19 crisis on private equity funds in emerging markets, examining both the negative implications and potential opportunities that have emerged.

1. The Initial Shockwave

The onset of the Covid-19 pandemic sent shockwaves through global financial markets, leaving private equity funds, particularly those in emerging markets, vulnerable. As countries implemented lockdown measures and businesses halted operations, private equity firms faced a flurry of uncertain outcomes. The sudden decline in economic activity led to a decline in deal flow, as sellers withdrew from the market and buyers exercised caution.

The initial shockwave of the crisis resulted in a decrease in the value of existing investments due to market volatility. Disruptions in global supply chains and the uncertainty surrounding future cash flows forced private equity funds to reassess their portfolios. This led to a shift in investment strategies, focusing on stabilizing existing investments instead of seeking new opportunities.

4.1 out of 5

| Language | : | English |

| File size | : | 1191 KB |

| Print length | : | 12 pages |

| Screen Reader | : | Supported |

2. Operational Challenges and Portfolio Management

Private equity funds in emerging markets have had to grapple with numerous operational challenges arising from the pandemic. The inability to conduct due diligence, frequent travel restrictions, and limitations on physical meetings have disrupted deal-making processes. This has made it incredibly difficult for funds to carry out effective evaluations and execute transactions seamlessly.

Moreover, portfolio companies within private equity firms have encountered significant challenges. The sudden drop in consumer demand and revenue streams created financial distress and prompted the need for rapid operational adjustments. Firms had to work closely with portfolio companies to devise strategies for remote working, cost optimization, and maintaining liquidity.

3. Opportunities in the Crisis

Amidst the challenges, the Covid-19 crisis has also unveiled opportunities for private equity funds in emerging markets. The disruption caused by the pandemic has accelerated certain trends, opening doors for investments in sectors like healthcare technology, e-commerce, digital infrastructure, and remote collaboration tools.

As industries adapt to the new normal, private equity funds can identify emerging market companies that can thrive in a post-pandemic world. These include businesses that leverage technology and automation to enhance efficiency, those with resilient supply chains, and companies with innovative solutions to address new consumer needs.

4. Adaptation and Future Outlook

The Covid-19 crisis has compelled private equity funds in emerging markets to adapt their investment approaches and operational frameworks. Firms have shifted towards more cautious and conservative investment strategies, focusing on sectors resilient to future crises. Due diligence processes have been reimagined to accommodate remote work, and increased emphasis has been placed on managing liquidity and financial risks.

Looking ahead, private equity funds in emerging markets are expected to capitalize on the recovery phase. The availability of distressed assets at attractive valuations, coupled with an anticipated surge in investment activity, presents opportunities for funds to generate long-term returns.

The impact of the Covid-19 crisis on private equity funds in emerging markets cannot be overstated. The initial shockwave and subsequent operational challenges have disrupted the traditional investment landscape. However, amidst the challenges, the crisis has also created windows of opportunity for funds to invest in sectors poised for growth.

As private equity firms adapt to the new realities, they will play a critical role in supporting portfolio companies and contributing to economic recovery. The agility to navigate uncertainties and identify emerging trends will be vital for finding success in the post-pandemic era, ensuring continued growth and profitability for private equity funds in emerging markets.

4.1 out of 5

| Language | : | English |

| File size | : | 1191 KB |

| Print length | : | 12 pages |

| Screen Reader | : | Supported |

The role traditionally played by Private Equity Fund (PE Fund) investments in supporting private sector development in Emerging Markets (EMs) is being challenged by the COVID-19 pandemic. This note assesses how PE Funds in EMs may evolve as a result of the COVID-19 crisis, focusing on the Growth Equity and Venture Capital (VC) asset classes. Growth Equity funds, which focus on accelerating investees’ growth through operational enhancements, account for a significant share of PE Fund investments in several developing regions, while VC funds are a fast-growing vehicle in certain EMs and present specific opportunities related to technology and digitization in the context of the COVID-19 crisis. This note also discusses how selected ‘megatrends’ may impact these two asset classes in the medium term, along with opportunities for the industry and for enhanced DFI support. The intended audience for this note is international development practitioners, private equity professionals in emerging markets, and capital market analysts.

Allen Ginsberg

Allen GinsbergKathy Santo Dog Sense Kathy Santo - Unlocking the secrets...

Are you a dog lover who...

Raymond Parker

Raymond Parker10 Presidents Who Were Killed In Office - Shocking Truth...

Throughout history, the role of a president...

Isaac Asimov

Isaac AsimovUnveiling a World of Magic: Beautifully Illustrated...

Bedtime stories have always held a...

James Joyce

James JoyceThe Blind Parables: An Anthology Of Poems

For centuries, poetry has...

Clay Powell

Clay PowellRival Conceptions Of Freedom In Modern Iran

The Struggle for Freedom in...

Cristian Cox

Cristian CoxAdvances In Their Chemistry And Biological Aspects

In recent years,...

Dominic Simmons

Dominic SimmonsGetting Into Mini Reefs For The Marine Aquarium

Are you interested in enhancing the...

Vincent Mitchell

Vincent MitchellExploring the Intriguing Connection Between History,...

When one thinks of Chinese martial...

Christian Barnes

Christian BarnesMighty Meg And The Accidental Nemesis: Unleashing the...

In the world of superheroes, there are many...

Kirk Hayes

Kirk HayesA Journey through the World of Nhb Drama Classics: Full...

Welcome to a fascinating exploration of Nhb...

Gerald Bell

Gerald BellWeed Cross Stitch Pattern Rachel Worth - The Perfect...

Are you a stoner who loves a little...

Ernesto Sabato

Ernesto SabatoDiscover the Breathtaking Beauty of the South West Coast...

Are you ready for an...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Stanley BellDiscover the Easiest Way to Define and Train Neural Network Models with Just...

Stanley BellDiscover the Easiest Way to Define and Train Neural Network Models with Just... Clinton ReedFollow ·17.8k

Clinton ReedFollow ·17.8k Thomas PowellFollow ·10.8k

Thomas PowellFollow ·10.8k August HayesFollow ·3.1k

August HayesFollow ·3.1k David PetersonFollow ·3.7k

David PetersonFollow ·3.7k Bernard PowellFollow ·5.6k

Bernard PowellFollow ·5.6k Damon HayesFollow ·9.6k

Damon HayesFollow ·9.6k Julian PowellFollow ·8.8k

Julian PowellFollow ·8.8k Felix CarterFollow ·14.6k

Felix CarterFollow ·14.6k