Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

How to Effectively Control Bank Credit Risks in Companies and Investments

When it comes to managing credit risks within companies and investments, it's crucial to employ effective control measures for optimum financial stability. In this article, we will explore how utilizing the Six Sigma methodology can help companies mitigate credit risks and ensure long-term success.

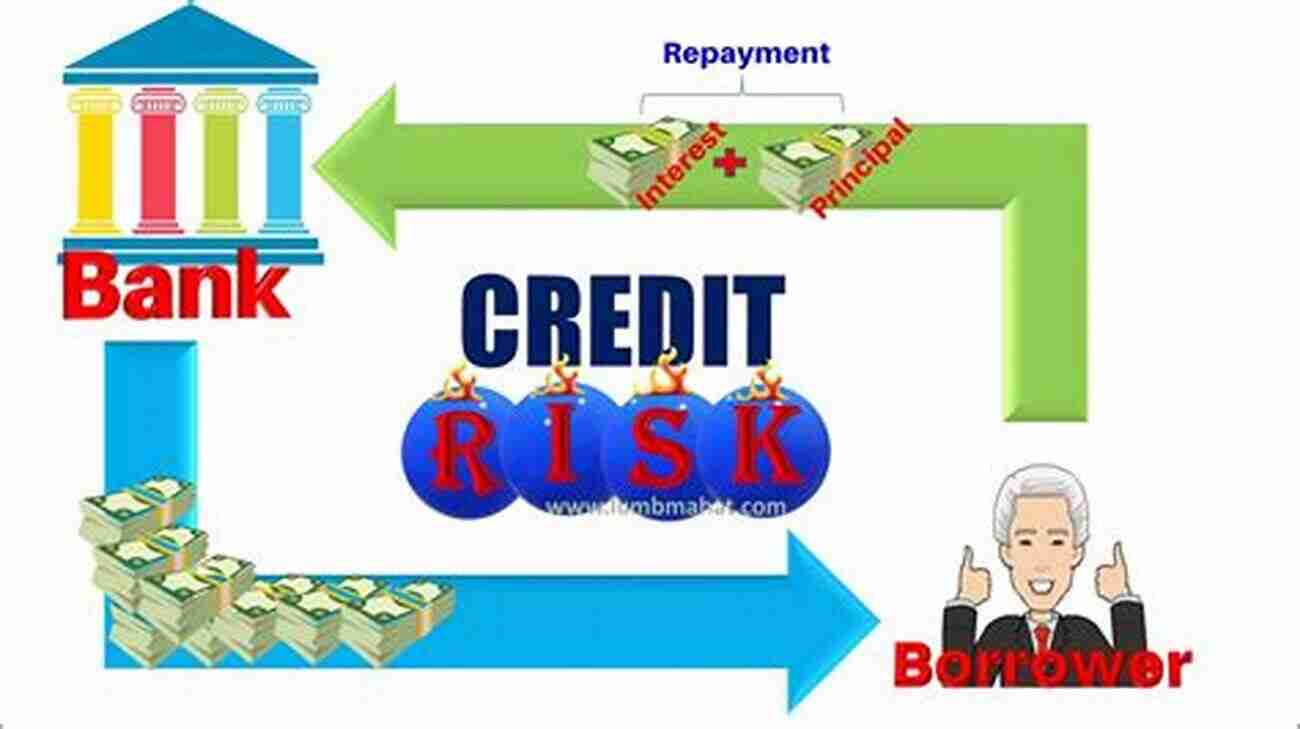

Understanding Bank Credit Risks

Bank credit risks refer to the potential losses a financial institution can incur due to the borrower's inability to repay the loan or meet their financial obligations. These risks arise from various factors, including economic conditions, industry-specific challenges, or even the borrower's financial instability.

For companies that heavily rely on borrowed funds or investors who have financial stakes in such companies, credit risks pose a significant threat to their profitability and sustainability.

4.1 out of 5

| Language | : | English |

| File size | : | 4538 KB |

| Screen Reader | : | Supported |

| Print length | : | 30 pages |

| Lending | : | Enabled |

| Paperback | : | 83 pages |

| Item Weight | : | 3.12 pounds |

| Dimensions | : | 6.1 x 0.2 x 9.25 inches |

The Role of Six Sigma in Credit Risks Mitigation

Six Sigma is a data-driven methodology widely used in industries to improve process efficiency and reduce defects. While its primary application is in quality management, it can also be a powerful tool for managing credit risks in companies and investments.

By adopting Six Sigma principles, organizations can identify and control potential credit risks, ensuring a proactive approach towards financial stability. The methodology offers a structured and systematic framework that allows companies to assess, measure, and monitor their credit risks effectively.

Phases of Implementing Six Sigma in Credit Risk Control

Implementing Six Sigma in credit risk control involves several key phases:

1. Define

In this initial phase, organizations define the problems or challenges related to credit risks. Identifying the scope, goals, and desired outcomes helps set the foundation for a successful credit risk management strategy.

2. Measure

Once the problems are defined, the next step is to gather relevant data and measure the key metrics specifying credit risks. This involves analyzing historical data, identifying trends, and determining the potential impact of credit risks on the company or investment.

3. Analyze

During the analysis phase, organizations delve deeper into the identified credit risks and determine their root causes. By thoroughly examining the data, companies can uncover patterns, identify risk hotspots, and understand the factors contributing to credit risks.

4. Improve

Based on the findings from the analysis, actionable strategies and solutions are developed for credit risk mitigation. This phase involves designing and implementing effective measures to control credit risks, such as revising lending policies, diversifying investment portfolios, or enhancing credit monitoring systems.

5. Control

The final phase is focused on sustaining the improvements made and continuously monitoring credit risks. Organizations establish control mechanisms and performance measurement systems to ensure ongoing risk management. Regular reviews and periodic assessments are vital to evaluate the effectiveness of these measures.

The Benefits of Implementing Six Sigma in Credit Risk Control

Utilizing Six Sigma in credit risk control can result in several significant benefits:

1. Enhanced Risk Identification

The methodology helps companies identify credit risks that might otherwise go unnoticed. By analyzing intricate data patterns, organizations can uncover hidden risks, allowing them to take timely preventive actions.

2. Data-Driven Decision Making

Through the Six Sigma approach, organizations base their credit risk management decisions on concrete data, minimizing guesswork and subjective judgments. This data-driven decision-making process ensures a more accurate assessment of risks and enables companies to implement effective countermeasures.

3. Proactive Risk Mitigation

Six Sigma empowers companies to act proactively against potential credit risks rather than responding reactively after losses occur. By implementing preventive measures and constantly monitoring risk factors, organizations can minimize financial uncertainties and promote stability.

4. Continuous Improvement

The cyclical nature of the Six Sigma methodology encourages companies to consistently evaluate and improve their credit risk management efforts. This ensures that credit risks are effectively controlled in the long run, safeguarding the organization's financial viability.

Managing credit risks is crucial for companies and investors to maintain financial stability and long-term success. By embracing Six Sigma principles, organizations can implement robust credit risk control measures. This data-driven methodology offers a systematic approach to identify, measure, analyze, improve, and control credit risks, leading to enhanced risk mitigation, proactive decision-making, and continuous improvement.

4.1 out of 5

| Language | : | English |

| File size | : | 4538 KB |

| Screen Reader | : | Supported |

| Print length | : | 30 pages |

| Lending | : | Enabled |

| Paperback | : | 83 pages |

| Item Weight | : | 3.12 pounds |

| Dimensions | : | 6.1 x 0.2 x 9.25 inches |

Beyond zero defect policy is the most sought material in financial circles. Known attempt to zero defect was made by American’s Goldman Sachs bank. Perfectly Six sigma study in financial application sense allow us to adapt six sigma theory for financial risk usage. We made practical program and made test new approach. All calculated data are inside this proposition for controlling risk less lending money. Test program is made in VBM Microsoft Excel for analysing 2300 enterprise’s risk, past profit volatility, financial sensitivity, tornado financial distribution and Monte Carlo profit prediction. One customer analysis with six sigma operation take maximum 30 seconds and you have opened all-risk’s information about enterprise to make safety decision about landing money. The bank can make also advice to enterprise how to improve financial result. The system is designed to control all kind of financial transaction: bank loans, stock exchange transactions and low risk portfolio, enterprises risks and his profit expectation. Now one can hide bad attention any more.

New approach into bank credit financial risk can help bank to reduce credit risk near zero.

Allen Ginsberg

Allen GinsbergKathy Santo Dog Sense Kathy Santo - Unlocking the secrets...

Are you a dog lover who...

Raymond Parker

Raymond Parker10 Presidents Who Were Killed In Office - Shocking Truth...

Throughout history, the role of a president...

Isaac Asimov

Isaac AsimovUnveiling a World of Magic: Beautifully Illustrated...

Bedtime stories have always held a...

James Joyce

James JoyceThe Blind Parables: An Anthology Of Poems

For centuries, poetry has...

Clay Powell

Clay PowellRival Conceptions Of Freedom In Modern Iran

The Struggle for Freedom in...

Cristian Cox

Cristian CoxAdvances In Their Chemistry And Biological Aspects

In recent years,...

Dominic Simmons

Dominic SimmonsGetting Into Mini Reefs For The Marine Aquarium

Are you interested in enhancing the...

Vincent Mitchell

Vincent MitchellExploring the Intriguing Connection Between History,...

When one thinks of Chinese martial...

Christian Barnes

Christian BarnesMighty Meg And The Accidental Nemesis: Unleashing the...

In the world of superheroes, there are many...

Kirk Hayes

Kirk HayesA Journey through the World of Nhb Drama Classics: Full...

Welcome to a fascinating exploration of Nhb...

Gerald Bell

Gerald BellWeed Cross Stitch Pattern Rachel Worth - The Perfect...

Are you a stoner who loves a little...

Ernesto Sabato

Ernesto SabatoDiscover the Breathtaking Beauty of the South West Coast...

Are you ready for an...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Cormac McCarthyFollow ·8.5k

Cormac McCarthyFollow ·8.5k Colin RichardsonFollow ·16.4k

Colin RichardsonFollow ·16.4k Tom HayesFollow ·2.1k

Tom HayesFollow ·2.1k Ismael HayesFollow ·16.5k

Ismael HayesFollow ·16.5k Ralph EllisonFollow ·4.3k

Ralph EllisonFollow ·4.3k Robert HeinleinFollow ·8k

Robert HeinleinFollow ·8k Sean TurnerFollow ·18k

Sean TurnerFollow ·18k Joel MitchellFollow ·4.1k

Joel MitchellFollow ·4.1k